Beneficial

Access our easy and rapid services anywhere. A single document completes your application

Access our easy and rapid services anywhere. A single document completes your application

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

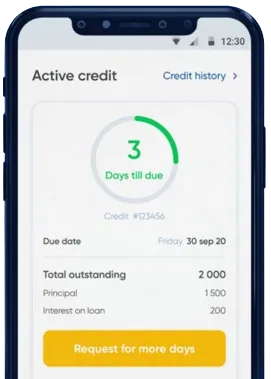

Send in your loan application using our app by filling out a quick form.

Hold on for our response, coming in just 15 minutes.

Collect your money, with transactions often completed in one minute.

Send in your loan application using our app by filling out a quick form.

Download loan app

In Kenya, instant mobile loans have become increasingly popular as a quick and convenient way to access emergency funds. These loans are provided through mobile money platforms, allowing borrowers to apply and receive funds instantly using their mobile phones.

Instant mobile loans in Kenya offer numerous benefits and can be incredibly useful in various situations. Let's explore some of the key advantages of these loans and how they can help you in times of financial need.

One of the primary benefits of instant mobile loans in Kenya is the convenience and speed they offer. Borrowers can apply for a loan anytime, anywhere, using their mobile phones. The entire process is quick and straightforward, with funds usually being disbursed within minutes.

With instant mobile loans, you can access funds in emergencies or unexpected situations without having to wait in long lines or fill out lengthy paperwork.

Instant mobile loans in Kenya are easily accessible to a wide range of borrowers, including those who may not have access to traditional banking services. As long as you have a mobile phone and an active mobile money account, you can apply for an instant loan.

These loans are particularly beneficial for individuals in rural areas or underserved communities who may not have easy access to physical bank branches. Instant mobile loans provide a convenient and inclusive way for these individuals to access financial support when needed.

Another advantage of instant mobile loans in Kenya is the flexibility they offer in terms of repayment. Borrowers can choose from various repayment options, including daily, weekly, or monthly installments. This flexibility allows borrowers to select a repayment schedule that aligns with their financial situation and ensures timely repayment.

Having the ability to customize your repayment plan can help you manage your finances effectively and ensure that you meet your loan obligations without feeling overwhelmed.

Instant mobile loans in Kenya are designed to prioritize security and transparency for borrowers. Lenders use advanced technology and encryption to safeguard borrowers' personal and financial information, ensuring that data remains secure throughout the loan application process.

Additionally, the terms and conditions of instant mobile loans are typically clear and transparent, allowing borrowers to understand the fees, interest rates, and repayment terms upfront. This transparency helps borrowers make informed decisions and avoid any surprises during the loan repayment period.

Instant mobile loans in Kenya offer numerous benefits and can be a valuable financial resource in times of need. From convenience and speed to accessibility and flexibility, these loans provide a convenient and inclusive way for individuals to access emergency funds. If you find yourself in need of quick cash, consider exploring instant mobile loans in Kenya as a viable solution.

Instant mobile loans in Kenya are short-term loans that can be accessed quickly and conveniently through mobile phone applications or USSD codes.

Users can apply for instant mobile loans by downloading the lending app, registering their details, and requesting a loan amount. The loan is disbursed directly to the user's mobile money account.

Typically, users need to have a registered mobile money account, a valid national ID, and a good credit score to qualify for instant mobile loans in Kenya.

No, instant mobile loans in Kenya are usually unsecured loans, meaning that borrowers do not need to provide any collateral to access the funds.

The maximum loan amount varies depending on the lending institution, but it typically ranges from Ksh 500 to Ksh 50,000.

Most instant mobile loans in Kenya are disbursed within minutes of the application being approved, making them an ideal option for those in need of quick cash.